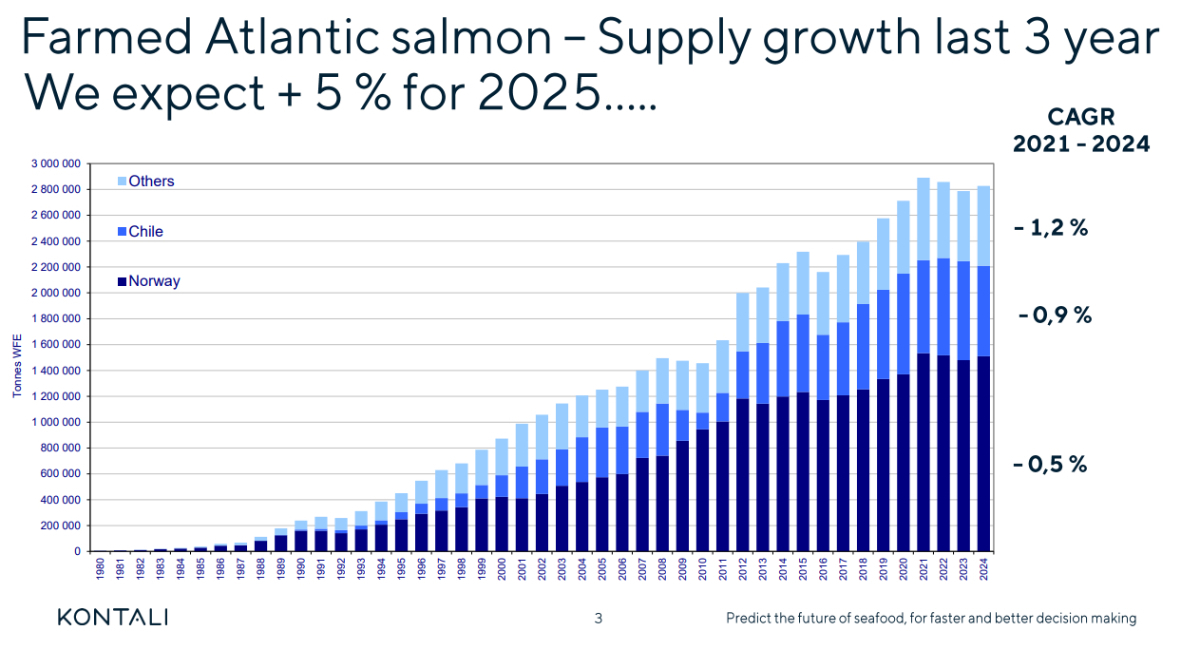

Salmon production ‘set to grow 5%’ in 2025

The supply of Atlantic salmon is set to grow by 5% this year, according to analysts at Kontali.

Norway-based Kontali’s latest forecast for 2025 is based on the expectation of higher biomass, strong production, and lower losses in the first quarter of this year.

The 5% forecast is in contrast to bullish predictions from Oslo-listed salmon companies, which project volume growth of nearly 11% this year, while at the other end of the spectrum, industry commentators expect growth as low as 3%, or even 2.5%.

Kontali’s estimate is based on three to five year averaged productivity parameters, which serve as the reference point for the most likely scenario.

Lead Analyst, Salmonids with Kontali, Lars Daniel Garshol, said: “With fourth-quarter 2024 results now in, supply growth estimates for 2025 are all positive, but projections vary significantly.

“Company guidance suggests a growth potential exceeding 80,000 tonnes WFE, or nearly 11% year-on-year, but industry projections have often been overly optimistic.

“The gap between company guidance and actual harvests over the past decade underscores how extraordinary events and shifts in productivity have led to inflated forecasts.

“Historically, company guidance has factored in expected biological improvements—such as reduced losses, increased weights, and improved yields—more optimistically than final outcomes.

“While this aligns with production trends in recent years, we believe it underestimates the current fundamentals and outlook.”

Kontali believes that optimising idle capacity in 2025 will depend on reducing losses and improving growth performance in the first half of the year.

Maximising biomass utilisation from September to November will be key, alongside fewer sea lice treatments and lost feeding days. Increased turnover and shorter production time at sea will drive efficiency, while new cage technology—such as closed and sheltered systems—will play a crucial role in unlocking growth, Kontali argues.

Garshol said: “As ever, biosecurity is key to unlocking growth in the salmon sector, reducing losses and improving turnover and utilization.

“Despite 70 million more fish being stocked in the sea since 2019, Maximum Allowable Biomass (MAB) capacity has grown just 1%, leaving untapped potential.

“With strong growth expected in the 2024 generation, MAB utilisation could see major gains in late 2025 and into 2026.

“Furthermore, the 2023 generation had the weakest smolt yield in over 20 years, nearly 10% below the 10-year average.

“As such, a conservative recovery in smolt yield is expected, but regulatory limits will cap weight gains in the second half of the year.”