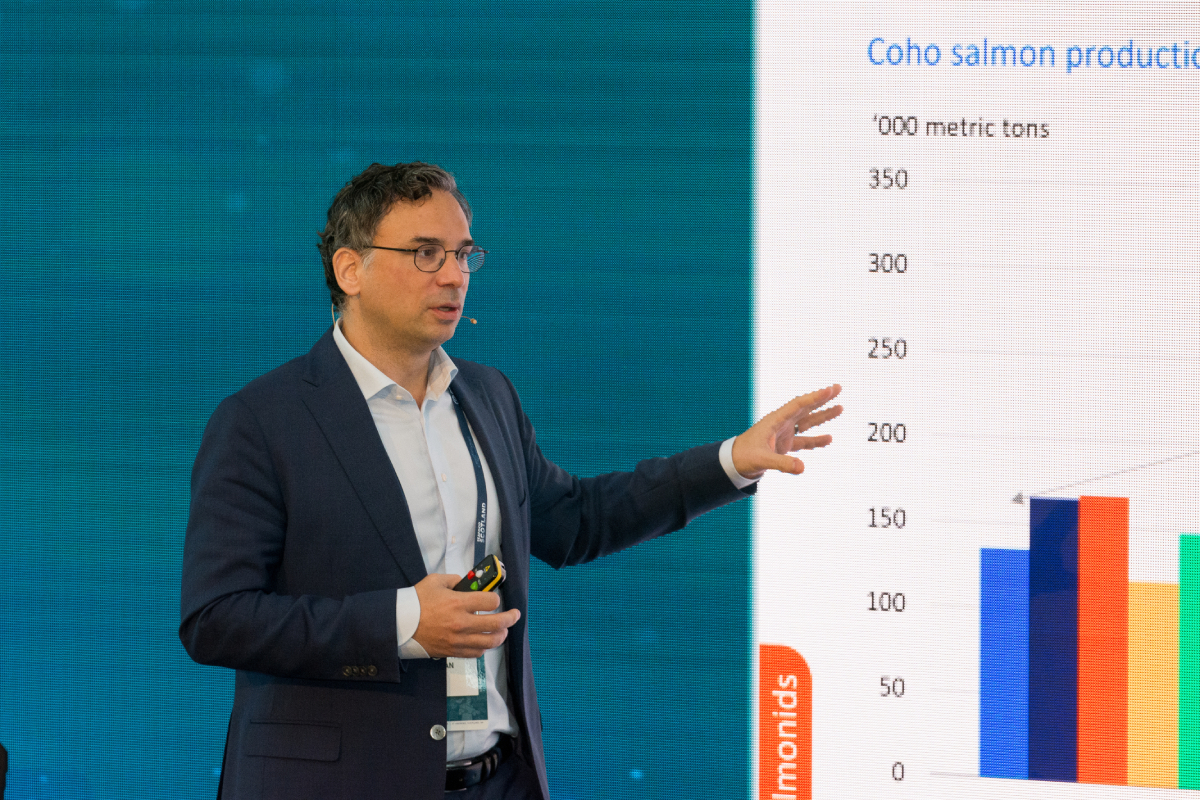

Rabobank cautiously optimistic for 2025

Despite fears over tariffs and inflation, the global aquaculture sector is poised for growth in the first half of 2025, according to analysts at Rabobank.

The bank’s forecast for H1 2025 is wary but, on the whole, upbeat and in line with the recent 12-month global outlook, also from RaboResearch, published in December last year.

The salmon industry is expected to continue its recovery with fewer biological challenges, while shrimp farmers anticipate improved margins as oversupply issues diminish.

Inflation is easing in Western countries, potentially boosting demand for seafood. However, the recent US presidential win by Trump could trigger trade war-induced inflation, affecting disposable incomes and shifting demand toward more affordable proteins like chicken.

In China, ongoing economic uncertainty and the need for fiscal support may hinder demand recovery for aquaculture products in the first half of 2025, the report says. Additionally, fishmeal prices are expected to face downward pressure as they adjust to the lower prices of feed alternatives.

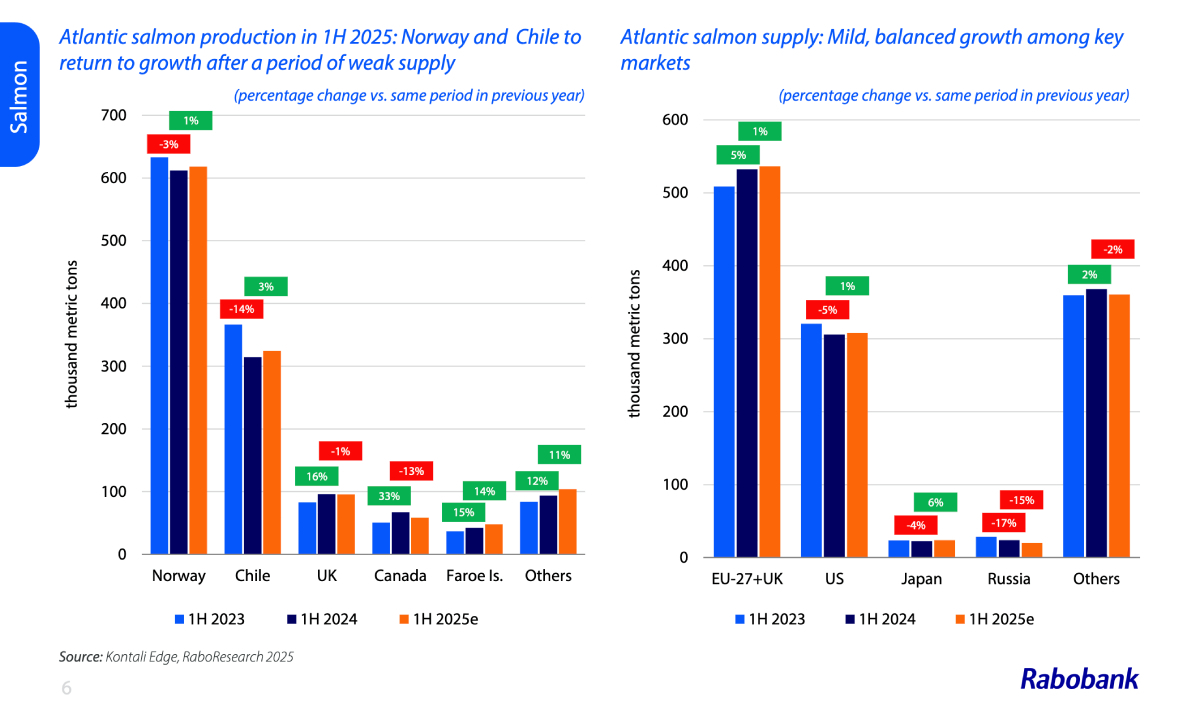

Salmon prices expected to remain elevated but competitive

Following a challenging 2024, the global salmon industry is on a path to mild recovery, the report says, with growth anticipated between 1% and 2% in the first half of 2025, provided no unforeseen biological issues arise.

Norway is better prepared for biological challenges, and the El Niño-related problems that affected Chile in 2024 are not expected to recur. However, low biomass will limit supply growth in the first half of the year, with further gains in the second half dependent on resolving lice issues from 2024.

Gorjan Nikolik, Senior Seafood Analyst for RaboResearch, said: “Given the tight supply and improving demand, we expect salmon prices to remain supported in the first half of 2025, though they will not reach the peaks seen in early 2024.”

Shrimp prices on a path to recovery

Shrimp prices are anticipated to continue their gradual recovery as supply adjustments lead to a more balanced market. The second half of 2024 saw a slowdown in supply growth and a recovery in prices in Western markets alongside declining feed costs that benefited shrimp farmers. While these factors provide a positive outlook for the first half of 2025, uncertainties persist. Chinese demand remains uncertain, EU demand growth may weaken, and potential US tariffs pose risks.

“We expect growth rates to remain low, particularly in Ecuador, due to uncertain Chinese demand,” said Nikolik. “Asian suppliers also face volatility from Western buyers and possible disease pressures, which could offset the advantages of lower feed costs.”

Fishmeal prices under pressure

Fishmeal prices are expected to face downward pressure as they adjust to the lower prices of feed alternatives. The return of La Niña and neutral conditions have increased fishmeal supply from Peru, compensating for weaker supply from Europe. This, combined with an ample supply of vegetable alternatives, has led to a partial correction in fishmeal prices.

Fishmeal and fish oil production rebounded in 2024 as El Niño effects subsided in Peru. The current fishing season in Peru, running from November 2024 to January 2025, is expected to deliver strong supply growth early in 2025, exerting pressure on prices, which have already corrected significantly.

According to Nikolik, there is optimism for Peru’s first season in 2025, likely starting in May or June, given the expected La Niña or neutral climate conditions in the Pacific Ocean.