Global aquafeed production falls as animal feed grows

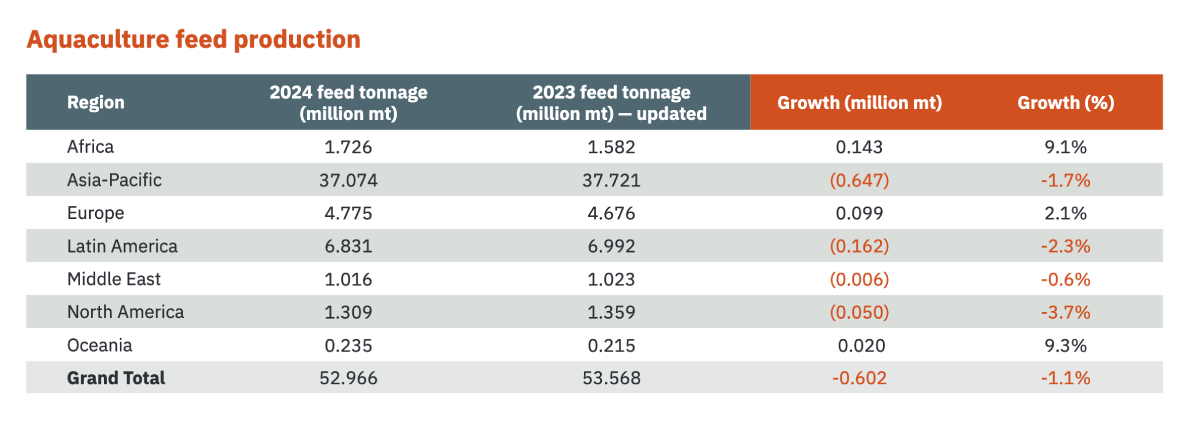

Worldwide feed production for the aquaculture sector declined slightly in 2024 by 1.1%, in 2024, in contrast to the animal feed sector as a whole, which grew by 1.2%.

Total aquafeed production was to 52.966 million tonnes. The figures come from the global feed production survey, published as part of the annual Agri-Feed Outlook compiled by leading feed business Alltech.

The slight decline overall in aquafeed continues a downward trend starting in 2023. It conceals considerable regional divergence, however, including gains in Latin America, Africa and Europe.

Alltech says the considerable decreases in Asia-Pacific and North America due to disease challenges, extreme weather events, cost pressures and low market prices weighed down the entire sector.

Looking ahead, the survey predicts, aquaculture is positioned to strengthen slowly, but this recovery will likely remain uneven across regions.

Alltech says: “Potential rebounds in shrimp and finfish production in Asia-Pacific will depend on stabilised prices and biosecurity improvements. Latin America and Africa could continue their upward trajectories, and momentum around alternative feed ingredients in Europe is expected to pick up steam as regulatory frameworks and consumer demand increasingly emphasise sustainability.”

The survey also shows that global feed production rebounded in 2024 after a stagnant 2023, increasing from 1.380 billion metric tonnes (+1.2%) to 1.396 billion tonnes.

Alltech says: “This growth – which was achieved despite challenges that included highly pathogenic avian influenza (HPAI), climate fluctuations and economic uncertainty – underscores the resilience and adaptability of the international agriculture industry.”

The annual survey collected data from 142 countries and 28,235 feed mills in 2024. By analyzing compound feed production and prices, collected by Alltech’s global sales team and in partnership with feed associations and official data-collecting organisations.

The top 10 feed-producing countries in 2024 were China (which produced 315.030 million mt of feed, down 2.03% from 2023), the U.S. (269.620 million mt; +0.68%), Brazil (86.636 million mt; +2.43%), India (55.243 million mt; +4.56%), Mexico (41.401 million mt; +1.38%), Russia (38.481 million mt; +8.53%), Spain (35.972 million mt; +1.46%), Vietnam (25.850 million mt; +3.41%), Türkiye (24.502 million mt; +4.83%) and Japan (24.297 million mt; +0.14%).

Together, the top 10 countries produced 65.6% of the world’s feed and 52% of all global feed production was concentrated in just four countries: China, the US, Brazil and India.