Biological issues in Scotland hit Q3 profits at Bakkafrost

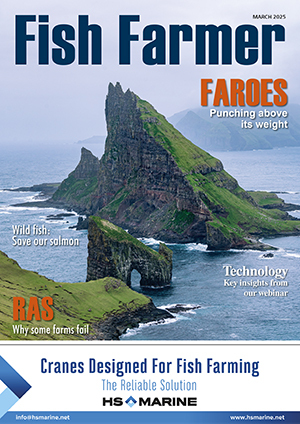

Bakkafrost today unveiled a sharp drop in third quarter operating profits, blaming the situation on various problems in Scotland and the Faroe Islands.

The group’s operating EBIT was 70.5 million Danish kroner (DKK) or around £8m, against DKK 102.7m (£11.8m) in Q3 last year.

The results are well down on what many analysts had been expecting. Bakkafrost’s shares fell by around 13% or almost NOK 6 billion on the Oslo Stock Exchange following the presentation of today’s results. Some analysts were describing the results as “terrible” and at least 70% below expectations.

Bakkafrost harvested 21,900 tonnes – 14,900 tonnes from the Faroe Islands and 6,900 tonnes from Scotland

The Faroes farming segment made an operational EBIT of DKK 135.1m (£15.5m) while the Scottish farming segment produced an operational loss of DKK 81.3m -£9.3m)

But the overall results for the year so far look better with profits for the first nine months totalling DKK 967.2m £111m) against DKK 500.5m (£57.4m) in 2020.

Bakkafrost CEO Regin Jacobsen said the Q3 results were weakened by several factors in Scotland and in the Faroes including a deliberate decision to advance the harvest at one Faroese site in order to synchronise production plans with a neighbouring site.

“This resulted in higher costs, lower harvest weights and price achievements in this quarter,” he explained.

“This is a once-off and going forward we will benefit from having the sites synchronised with better control of biological risks and enhanced operational efficiency.

He continued: “The results have also been negatively affected by delays in the installation of new delousing equipment on the MS Martin, which is our main delousing farming supply vessel in the Faroes.

“These delays were in part caused by Covid-related supply issues and caused loss of precious time and momentum in our preventive delousing operation. In turn, this has led to higher mortalities in this quarter.”

Jacobsen said that in Scotland the company suffered significant biological challenges at some of its farming sites where the fish had reduced gill health.

“At the end of the quarter, sudden biological issues occurred, such as blooms of micro-jellyfish, which caused significant mortalities.

“It was some relief that in September we could deploy our new farming supply vessel, Bakkanes, into operation in Scotland to do treatments. “

He continued: “As we progress further with our planned investments in Scotland, the biological risk will be reduced with more preventive and treatment vessel capacity to protect gill health of the fish.

“Already in 2022, we will have more freshwater treatment capacity available and once our new hatcheries will be completed and produce large smolt this will be game-changing for the operation. The improvements will be gradual, and it will take some years to achieve the transformation, we are planning for.”

He concluded: “Regarding the market, we have seen a further normalisation after the Covid-19 caused disruption. Compared to the same quarter last year, the global supply increased around 6% in this quarter, prices have increased 14% and Bakkafrost has increased the sale to the foodservice industry to 65% of the harvested volume in the Faroe Islands, much in line with our strategy.”

On its Capital Markets Day in September Bakkafrost unveiled a four year investment plan totalling DKK 6.2 billion.

[caption id="attachment_83419" align="alignnone" width="220"] Bakkafrost CEO Regin Jacobsen[/caption]

Farm Technician (Skipport) - Mowi Scotland

Western Isles£27,236 to £30,504 per annum

Agricultural Consultant - SAC Consulting

ThursoSalary On Application

Processing Operative - Bakkafrost Scotland Limited

Cairndow£22,313.50 to £23,429.18 per annum

Aquaculture Technical Co-ordinator - Scottish Sea Farms Ltd

Orkney, Shetland£30,000 to £35,000 per annum

Processing Staff - South Shian - Scottish Sea Farms Ltd

PA37 1SB£25,028 per annum