Bakkafrost sees lower profits overall, but better revenue for Scotland

Bakkafrost today reported lower than expected operating profits for the final quarter of last year although Scotland continued to show marked improvement on a number of fronts.

The group produced an operational EBIT of 280 million Danish kroner (£31.4m) against DKK 356 million (£40m) a year earlier.

However, Scottish revenues were well up this time – from DKK 84 million (£9m) to DKK 286 million (£32m) this time. The operational loss was reduced considerably – from DKK 104 million (£11.6m) to DKK 31m (£3.4m).

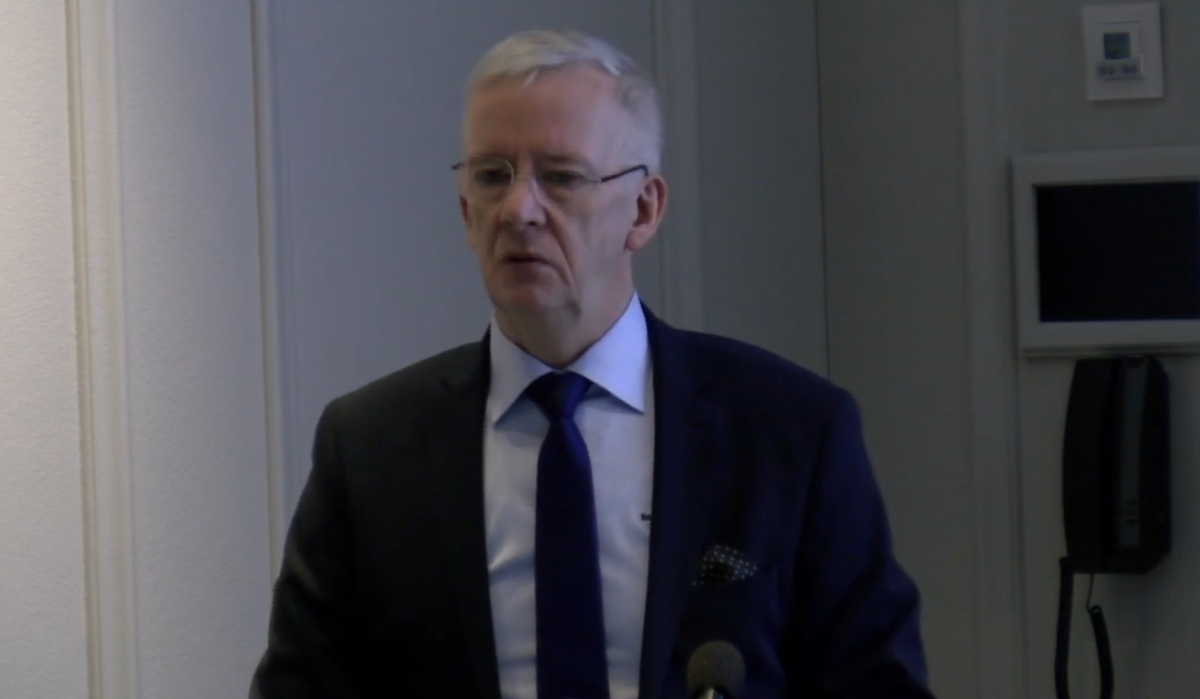

Bakkafrost CEO Regin Jacobsen said mortality in Scotland was down and the quality of fish was high.

Summing up Bakkafrost’s performance during the October to December period, he commented: “The Freshwater and Farming operations in Faroe Islands had a strong development in this quarter.

“Biological performance remains robust, with solid growth, effective sea lice management, and harvesting of large fish.

“We are also pleased with the continued progress in our freshwater segment, which has set new production records for the second consecutive quarter of producing large, high-quality smolt. This improved efficiency is helping to reduce costs.”

On Scotland, he continued: “The transition to producing large, high-quality smolt at Applecross has begun.

“As we scale up production this year and gradually replace legacy fish from our marine farms with high-quality fish, we expect a fundamental transformation of our farming operations from next year onwards.

“Overall, we are pleased with the de-risking of our Scottish operations in 2024. Mortality has decreased significantly, and fish harvested in the quarter was large, contributing to the highest full-year EBITDA since the acquisition.

“As we await the full replacement of legacy fish, we will continue a similar de-risking strategy in 2025, before starting the journey to ramp up production from 2026.”

Jacobsen said that stronger supply growth had contributed to downward price pressure with the market price for salmon was weaker than expected this quarter, negatively impacting the margin.

He said: “Three major projects are progressing well – the Applecross and Skálavík hatcheries and the expansion of Havsbrún feed factory. These projects are crucial to achieving our goals for 2028 and beyond with robust large smolt, best feed and good fish welfare.”

The total combined harvest in Q4 was 20,478 tonnes (17,067 tonnes in Q4 2023) with the Scottish harvest more than trebling from 1,064 tonnes to 3,840 tonnes. The Faroese harvest was up slightly by 633 tonnes to 16,638 tonnes.

Scotland plans are scaled down

Bakkafrost has decided to cut its investment plans for Scotland. Eighteen months ago it unveiled a four year DKK 6.3 billion (£700m) group investment programme up to 2028.

The programme was to enable a transformation of the operation in Scotland and provide sustainable growth in the Faroe Islands as well as Scotland.

The main purpose of the investments in Scotland is to replicate Bakkafrost’s successful operation in the Faroe Islands. A part of this is to implement Bakkafrost’s large smolt strategy in Scotland, which is achieved through building sufficient and energy-efficient hatchery capacity.

Today, Bakkafrost said it has decided to change the priority of some of the investment projects in Scotland, including the second planned hatchery at Fairlie and new processing facility.

The company’s Q4 update said: “…the capex (capital expenditure) spend in 2024 and 2025 is expected to reduce (by) around DKK 800 million in total, compared to the investment levels announced in the 2024-2028 plan.

It added: “With the investment plan, Bakkafrost expects to increase its total annual slaughter volume to 165,000 tonnes in 2028.

“During the same period, the total annual production capacity in Bakkafrost’s value chain will reach 200,000 tonnes gutted weight.”

It also said the global salmon product market’s long-term balance is likely to favour Bakkafrost. Bakkafrost has a long value chain and a cost-efficient production of high-quality salmon products and will likely maintain financial flexibility going forward.

For 2025, Bakkafrost expects to harvest around 77,000 tonnes gutted weight in the Faroe Islands and 20,000 tonnes gutted weight in Scotland, a total of around 97,000 tonnes gutted weight.

It also said that with the investment plan, Bakkafrost expects to grow the total annual harvest volumes, sustainably, to 165,000 tonnes in 2028.