Processing: 2024 in review

Processing companies experienced varying fortunes in what has been a challenging period.

The seafood arm of UK-based food processor and supplier Hilton started the year on a downbeat note, reporting a financial loss of just under £16m for the year to 1 January 2023. The board said, however, that Hilton Seafood “…is progressing very well with strong recovery plans”.

In September, we were able to report that continued improvement in the seafood sector had helped the Hilton Food group achieve growth in profits for the first half of 2024.

In its interim results for H1, Hilton reported revenue of £1.9bn and adjusted pre-tax operating profit of £33.5m, representing respectively a revenue fall of 8.4% year-on-year but profit growth of 25.3%.

In February, leading seafood processing companies Marel and MMC First Process announced that they had entered a strategic partnership. In a joint statement they said: “By filling in complementary gaps, the alliance enhances a complete product offering throughout the value chain, providing customers with the convenience of a comprehensive one-stop shop experience.”

They particularly highlighted their drive to reduce carbon footprint and enhance traceability in seafood.

In the UK, Sykes Seafood – which supplies a range of wild and farmed fish and shellfish – announced a rise in turnover of more than £100m for the year ending 1 April 2023. The company also saw pre-tax profits falling from £5m to £1.4m year-on-year, replicating a pattern seen across the seafood sector.

In March we reported that Mowi’s Fort William processing plant upgrade was nearing completion, with the assistance of processing specialists Marel.

Scott Nolan, Mowi’s Sales & Operations Director (UK, Ireland, Faroes and Iceland), said: “It was time to ensure our facility maximises throughput whilst maintaining the high quality that customers expect of Scottish salmon.

The last major upgrade to this facility came in 2006, and with the fast pace of the aquaculture sector, there are many new and innovative food processing solutions available to us today.”

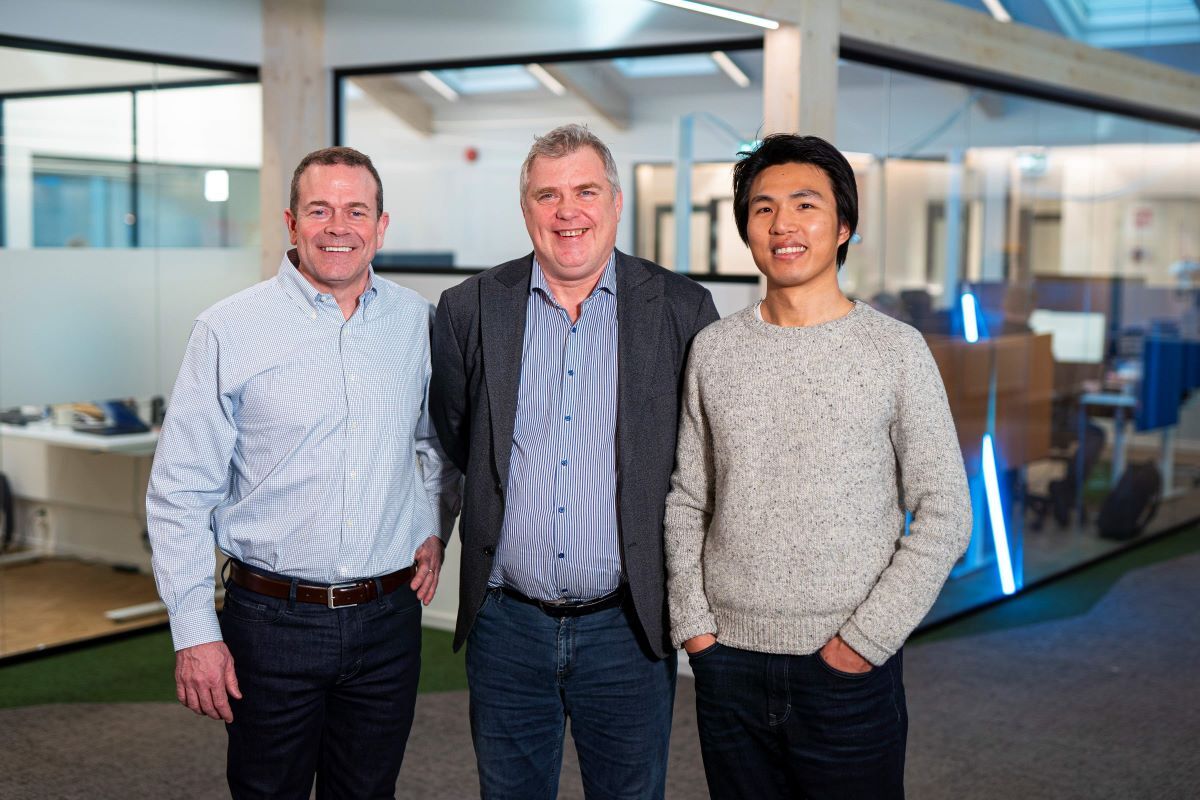

Maritech deal: (L-R Brian Rigney, CEO of CAI Software; Odd Arne Kristengård, CEO of Maritech; and Wesley Jiang, Vice President of private equity investor STG.

Meanwhile in the US, seafood processing software business Maritech was acquired by US technology group CAI Software. Maritech is a leading cloud-based enterprise resource planning provider for the seafood and logistics sectors across European and North American markets.

Maritech CEO Odd Arne Kristengård said: ”This is a great milestone for us and a natural next step towards global growth.”

In April we reported that Grieg Seafood was answering the call to process more salmon in Norway with a new processing facility near the capital, Oslo.

The NOK 130m (£10m) centre will be close to Gardermoen, Oslo’s main airport. The development is part of the company’s strategy to increase value creation and process more of its own fish.

The company said it plans to establish the processing factory in a new and energy-efficient facility at the airport. It will have an annual processing capacity of 10,000-12,000 tonnes (HOG equivalent), with an option of increasing the capacity to 20,000 tonnes if needed at a later stage. The project will create up to 60 new jobs.

Later, in May, we reported that BAADER had won the contract to fit a filleting system for the new facility.

Meanwhile, a row was brewing between Norway and the European Union over the former’s rules forbidding the export of “production” or lower grade fish. Norway’s rules constitute a barrier to free and fair trade, the European Commission concluded.

Under Norwegian Regulation No 844 on fish and fish products quality, Norwegian farmed salmon is sorted and marketed in three quality categories: superior, ordinary and production.

Salmon is placed in the lowest quality category (production) when the fish has wounds, malformations, treatment errors or similar minor defects. Salmon qualified under this quality category is prohibited by Norwegian law from being exported before these defects are corrected at Norwegian processing plants.

Earlier this year, the proportion of salmon exported as fillets rather than whole fish has grown, thanks to a high level of winter sores and other wounds.

The ban on exporting these fish to be filleted elsewhere suits Norway’s processing sector but has been challenged by Norwegian producers – including Mowi – and by trade associations in the Netherlands and Denmark, who believe that the opportunity to buy cheaper fish for processing is being denied to them.

In May, there was more grief for Norwegian salmon producer Lerøy, after it was claimed that another case of Listeria bacteria had been discovered at one of its sites, a Lerøy Midt slaughterhouse in Trondelag county.

In June we reported that the European Parliament had decided to press ahead with a potentially controversial change to the regulations around smoked salmon processing.

The new regulations centre on part of the production system known as the “stiffening process”.

Stiffening involves reducing the ambient temperature of fresh salmon between minus four and minus 14 degrees Centigrade after it has been filleted and smoked to help protect against bacteria.

But the industry fears it will cost many jobs especially in large salmon processing countries such as Poland and Denmark.

In July, Mowi’s new combined slaughterhouse and processing plant at Jøsnøya in Norway’s Hitra region started production. The plant has a production capacity of 100,000 metric tons – enough to process around a third of Mowi’s production in Norway – and it replaces Mowi’s factory at Ulvan.

The plant will receive fish from sea harvest vessels only. Mowi Norway is now using four sea harvest vessels to supply its processing plants, and the South Region in Norway is already fully based on this technology.

Also in July, Klaus Nielsen announced he was stepping down as CEO of Danish seafood processor Espersen after nearly 25 years in the role. His successor is Tino Bendix, formerly CEO of veterinary equipment business Kruuse, who took over as CEO both of Espersen and its parent company, INSEPA, in August.

Espersen’s headquarters are in Denmark but it also runs the former UK operation of Iceland Seafood International, based in Grimsby, which it acquired in August last year.

In August we reported that Bakkafrost Scotland was planning to mothball its harvest and processing facilities in Stornoway, on the Isle of Lewis, with 80 jobs likely to be affected.

The sites affected are the processing facility, in Stornoway’s Marybank industrial estate, and the harvest station at Arnish.

The company said that there would be very little requirement for harvesting or processing over the next 18 months in its operations in the north of Scotland.

A spokesperson for Bakkafrost Scotland said: “Our board has been forced to consider extremely difficult scenarios in order to futureproof the business and secure our remaining staff across Scotland. One of the scenarios proposed is that we close the Arnish Harvest Station and the Marybank Processing Facility, for an extended period.”

It is so far unclear whether the closure will indeed be a temporary or a permanent blow to the island’s economy.

Potentially better news for Scotland came in September with the suggestion that salmon sales could receive a lift following the takeover of Danish processing company Insula Hvide Sande.

The Norwegian company First Seafood, based in Bergen, announced its decision to acquire 100% of the shares in the company.

First Seafood Chief Commercial Officer Roy Olsen said the acquisition should give an increase in filleting capacity up to around 40,000 tonnes.

He said that the location gives it a larger sourcing capacity, meaning that it will now be buying salmon from Scotland, Iceland and the Faroe Islands as well as Norway.

In September, fingers were pointed at Mowi’s Blar Mhor processing plant near Fort William after an apparent pollution incident involving fish waste. The company denied the claims and said its operating procedures and CCTV had been thoroughly checked.

A spokesman said: “Mowi is not the only business which processes this type of material on the Blar Mhor Industrial Estate, but it is the only one regulated by SEPA [the Scottish Environment Protection Agency] under IPPC [Integrated Pollution Prevention and Control] regulations.”

In November, we reported that agreement had been reached for the purchase of the assets of the Icelandic seafood processing equipment company Skaginn 3X, which filed for bankruptcy in the summer.

A group of investors with the firm KAPP, another Icelandic technology company, agreed to buy all the equipment and liquid assets of the Skaginn estate in Akranes.

Skaginn 3X was a well-known name in the world of seafood processing and aquaculture equipment, but it filed for bankruptcy earlier in the year, and more than 120 staff were laid off despite attempts to save the company. Now a new company, KAPP Skaginn, has been created to move the operation forward.

Finally, the Global Seafood Alliance released the latest version of its Seafood Processing Standard (SPS).

Version 6.0 includes a restructured modular framework built around core food safety requirements covering both farm-raised and wild-caught seafood, ten separate modules to accommodate the specific production processes and products at individual facilities, and enhanced data capture, reporting and assessment technologies.

The GSA said: “This new framework was designed specifically to improve audit efficiencies, provide elevated assurances for farm-raised and wild-caught seafood to consumers, and create a more customised, comprehensive certification option for seafood processors globally.”