Global outlook for feed sees prices easing

Increased supply in commodities is good news for fish farmers, as Robert Outram reports.

Feed makes up around half the day-to-day cost for a fish farmer, so when feed prices are high, as they have been for the past two or three years, it is bad news for profitability even when seafood prices themselves are high.

This has been a challenge for salmon farmers and an even tougher one for shrimp farmers, who have seen supply and demand forces working against them in recent times.

Could 2025 bring better news for the farmers? As Gorjan Nikolik, Senior Analyst with Rabobank focusing on the global seafood sector, explains, the commodities affecting aquafeed prices vary by species, but for both the salmonid and shrimp sectors, two key elements are soy protein and marine ingredients: fishmeal and fish oil.

Nikolik says: “The two main components are coming down in price. In the case of soy we have a third consecutive year, in 2025, of declining prices. The Americas are very important for soy production and conditions across the United States have been great for wheat, corn and soy. Also Brazil, which is now by far the leading exporter of soy, is having a record crop, as is Argentina.

“The supply has historically been absorbed by China, but it’s not being absorbed now, as China has very high stocks.”

The team at Rabobank expect to see a further 10% decline in soymeal prices next year.

Fishmeal and fish oil are also hugely important, both for aquafeed and for a variety of other uses. IFFO, the international marine ingredients organisation, tracks production trends and is well placed to give an idea of what direction supply is going.

Petter Johannessen, IFFO’s Director General, says: “Some fisheries play a bigger role than others, given their biomass size and their role in international trade and South America generally influences the prices of fishmeal and fish oil globally.

“With all-time high fishmeal and fish oil prices reached in Q3 2023 due to the El Niño phenomenon [a cycle affecting currents in the Pacific that drives weather events around the world], diminished fishmeal imports by China and a waning El Niño phenomenon as of Q2 2024, have impacted global fishmeal prices.”

2024 is proving to be a strong year for Peru’s anchovy fishing and fishmeal production, with a healthy biomass and a quota for the second fishing season among the highest of the decade.

IFFO says that, assuming landings in Peru in the fourth quarter of 2024 at around 2.0 million tonnes, we can expect global production in 2024 to be around 5.5 million tonnes of fishmeal and around 1.29 million tonnes of fish oil.

Johannessen adds: “We don’t speculate on future prices but every single metric tonne of fishmeal produced in the world is normally consumed. The demand for feed ingredients outpaces its supply worldwide and prices respond mainly to changes in the supply.”

The Peru fisheries have a key part to play in determining the price of fishmeal and fish oil, and increasing supply from this sector last year and this year suggests the cost of marine ingredients is set to fall further. Rabobank forecasts a further price drop of around 10% in 2025.

Fishmeal has fallen from its highest peak of around $1,900 (£1,566) to $1,600 (£1,319)per tonne, down by $300.

Fish oil saw the steepest peaks, from nearly $12,000/tonne (£989) , for human grade, and around $8,000 (£6,594) for aqua grade, certified, in early 2024. Now it is almost back down to $2,300 (£1,896).

Gorjan Nikolik says: “I think prices have a little bit to go before they bottom out.”

The impact on feed costs will depend on the species, as the ratio between fishmeal and soy varies. The time scale also varies a lot. Salmon has a long grow-out period, of 1.5 to two years. Although the most feed is consumed in the final six months, in terms of the production cost per kilo of fish, the price of feed over the whole growing cycle needs to be factored in.

As Nikolik explains, falls in commodity prices translate into feed costs almost immediately, but costs are effectively a moving average over the 1.5-2 years.

He says: “Given that we have this continuous decline… we can expect that throughout 2025 we should see gradually reducing feed costs per kilo of salmon, maybe 3 to 5% every quarter.”

For shrimp, a falling cost of feed takes effect much faster because the time to grow to market size is much less than for salmonids. But, as Nikolik explains, it depends where you are.

He says: “If you are a large Ecuadorian farmer, perhaps you benefit from the lower cost of feed quite quickly, but in Asia that is not at all guaranteed. The competition is so hard between the feed companies that, when commodities went up in price, in 2021 and 2022, only a small part of that rise was transferred to the farmers.

So the Asian farmers lost less then, but they will benefit less now.”

Ronald Faber, CEO and Global Aqua Lead with feed producer Alltech Coppens, is cautious about the prospects for cheaper feed: “We see some slight softening of the prices for 2025 as a result of lower commodity prices for a number of raw materials. Our expectation is also that it will be less firm if the expectations are based on the high landings of South American fishmeal. In the last decades fish feed started to become less dependent on marine fishmeal and fish oil and therefore the impact is limited.

“On the other hand, we see ever rising prices for energy, labour, transport and plant protein concentrates. All in all, our outlook is a slight reduction in feed prices over 2025.”

The price for consumers

Falling feed prices are good for producers, but how about the consumers? Nikolik suggests that the price of seafood in your local supermarket will probably not reflect the lower cost of soy or fishmeal.

As he explains: “It’s hard to see the link between feed costs and price. The price is created by the demand for fish or shrimp, and the supply. So feed price increases are absorbed by the farm.

“This is especially true for salmon.”

If feed costs do have an effect on consumer prices in the long run, it is through encouraging or discouraging producers, so that more will drop out of the market when their costs are high, and more will enter or increase production when it is more profitable.

Alternative options

Feed prices are overwhelmingly dominated by soy and fishmeal, but can farmers (or feed companies) mitigate price spikes for these commodities?

Alltech Coppens’ Faber says: “The obvious is to have a strong focus on efficiency in production to produce hog (head on, gutted) grade fish. But maybe even more important is to have the fish ready for market at the right moment when prices are right.

“At Alltech Coppens we support farmers with tailormade concepts and advice to optimise production and have the fish at market size and at right colouration when the market wants the fish. One of the examples is the fillet colour predictor, a tool that is designed to streamline the production process and reduce uncertainty at harvest.”

Gorjan Nikolik observes: “The big feed companies do substitute – they have advanced formulation technology and they are constantly looking to provide the same nutritional value at a lower cost. When fishmeal is very expensive, they will look to substitute it with soy concentrate, and the other way around too.”

He adds that sustainability is also an important consideration now for many feed producers and farmers, and this can influence their choice of protein sources.

IFFO’s Johannessen says: “Feed ingredient baskets now contain up to 40 or 50 main ingredients.

Diversification is key to resilience as in any sector. IFFO conducted a SWOT analysis for protein sources, published in the prestigious peer reviewed paper Reviews in Fisheries & Aquaculture.

“By better appreciating the positives and negatives of each ingredient, it becomes possible to increase fish farmers’ adaptability in responding to the various opportunities for their use in feeds.”

There is certainly a wide range of potential alternative sources for protein and oils. Advances in seafood processing technology mean that fish trimming, for example, now represents a bigger percentage of aquafeed.

As Gorjan Nikolik points out, however, creating fishmeal and fish oil for feed is not the optimal solution for fish trimmings. The best price can be achieved from products for human consumption, or even for medical applications.

He adds: “Alternative proteins not only have to compete with fishmeal, but they also have to compete with soy protein concentrate. It’s a difficult one to beat now that both soy and fishmeal have come down in price. This creates a risk factor, so it is difficult for these companies to get capital to scale up.

“If you have alternative markets, like the pet food industry, that’s good if you are an insect farmer, for example. At this point it’s difficult to see, on the protein side, a large source of alternatives in aquafeed, but the insect producers and others have been successful at raising capital. I think they will succeed, but it will take time.”

Without scale, it will be hard for alternatives to proteins or fish oil to compete on price. Although the long term may bring a more genuine choice for fish farmers, for now commodity price volatility means soy and marine ingredients look set to dominate the feed market for the foreseeable future.

The good news at least is that, for the fish farmers, commodity prices are moving in the right direction.

Specialist feed producer eyes growth

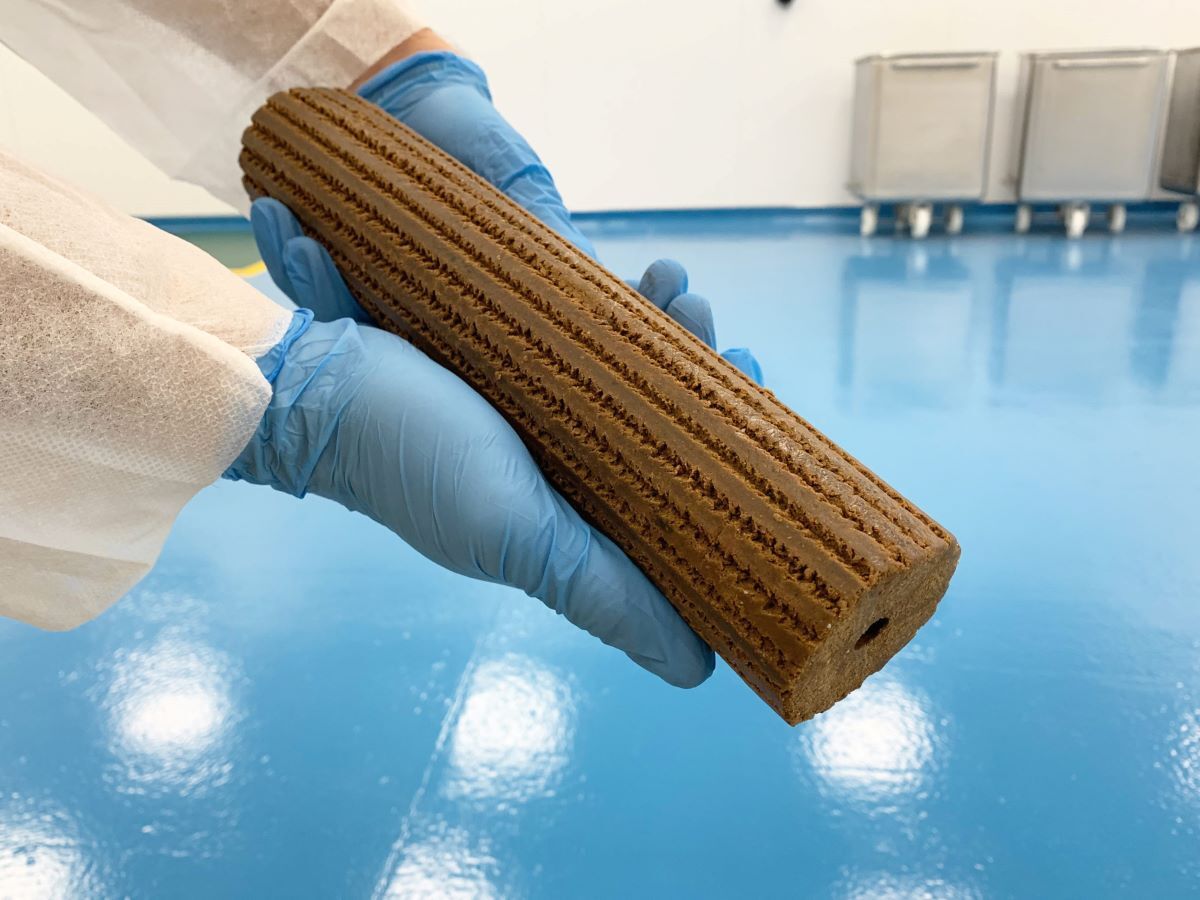

Based in Thorne, Yorkshire, World Feeds produces specialist aquatic feed for the international aquarium market and the retail sector. For the aquaculture industry, through its brand Vita Aqua Feeds (VAF), the compnay also produces feed blocks for wrasse and lumpfish used as cleaner fish.

As Sales Director Tom Noble explains, World Feeds is cautiously optimistic about commodity prices stabilising, but since the core of its product is based on marine ingredients from verifiable, quality European Union sources, falls in the global fishmeal and soy markets are not expected to have a significant impact.

Over the past year, the company has focused on further improving efficiency in its factory, and on developing the Norwegian market with its European distribution partner PT Aqua.

While some Norwegian salmon farmers have dropped the use of cleaner fish to control sea lice – and the country’s government is currently expressing concern over the care of cleaner fish – those farmers who have successfully addressed the welfare issues are looking to ensure they source quality feed for their wrasse and lumpfish.

World Feeds already supplies the major fish farmers in Scotland and is looking to address the North American market.

2024 was also the year in which the company obtained certification under the Global GAP scheme.

Noble says: “It was a good exercise and required a lot of detail, building on our current QMS [quality management system].

“As we are not a traditional feed mill, and have some unique processes, we had to make some adjustments to mneet Global GAP’s requirements.”

For the future, the company is exploring block feeds for cod and other species, which could reduce aggression compared with pellet feeding, and for halibut.

World Feeds is also looking at potential certification under the FSSC 22000 Scheme for Food Safety Management Systems, which applies to pet food and products for human consumption.

Consult our online business directory to find feed and feed system specialists