Faroes focus: Innovation and pragmatism

The Faroe Islands are a windswept archipelago in the north Atlantic, surrounded by challenging but very productive seas.

The island nation is a self-governing part of the kingdom of Denmark, and while it may not be the biggest producer in the fish farming world, the aquaculture industry in the Faroes has developed a reputation for innovation and success.

Fishing and fish farming are key industries, both in terms of the operators based on the islands and also the industries that support those sectors, from net makers and boatbuilders to research.

Fish farming in the islands is overwhelmingly about Atlantic salmon. The latest Global Outlook Report from RaboResearch/Kontali estimates that, in terms of salmon, production in the Faroes bounced back 10% last year to around 100,000 tonnes. The forecast for 2025 is for a further 13% increase, slightly plateauing in 2026 with a 4% increase.

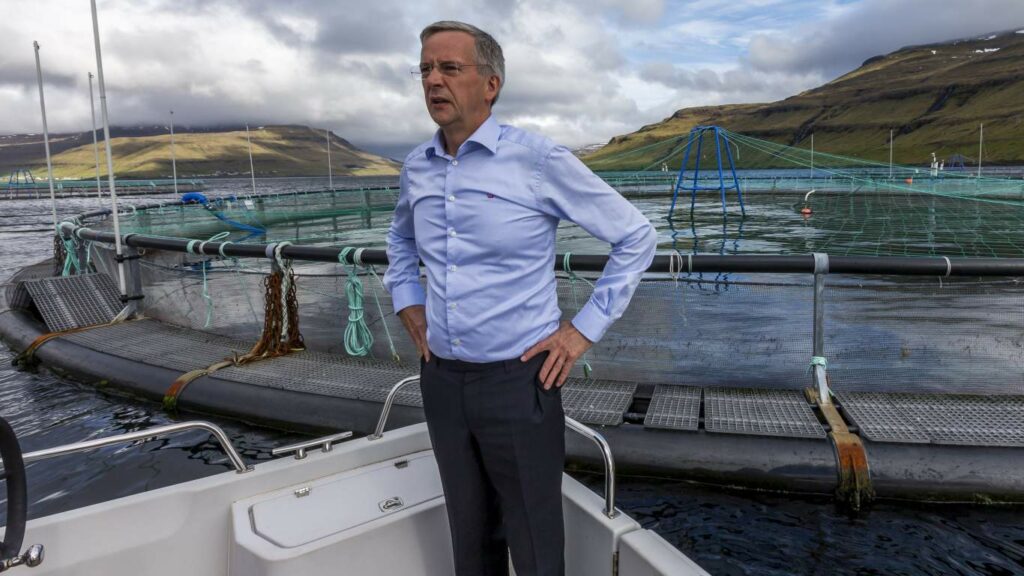

There are three leading salmon farmers operating in the Faroes: Mowi, Hiddenfjord and the largest, Bakkafrost. Fish Farmer caught up with Regin Jacobsen, Bakkafrost’s CEO, shortly after the company had published its trading update and financial results for the fourth quarter of 2024.

Jacobsen is upbeat despite the group reporting operational EBIT (earnings before interest and taxation) for the quarter of 280 million Danish kroner (DKK – around £31.4m) against DKK 356 million (£40m) a year earlier.

This was partly because things have been going well for Bakkafrost’s Scottish subsidiary, Bakkafrost Scotland, formerly the Scottish Salmon Company.

Jacobsen says: “I’m happy with the direction of our operation in Scotland. It’s going in the right direction. We have seen improved numbers.

“We are also seeing the upside in size and quality of our smolts as we go into 2025.”

Scottish revenues were well up for the quarter – from DKK 84 million (£9m) to DKK 286 million (£32m) this time. The operational loss was reduced considerably – from DKK 104 million (£11.6m) to DKK 31m (£3.4m).

Drawing on lessons learned from the Faroes operation, Bakkafrost is investing heavily in rearing larger smolts to ensure that by the time the fish are released into the sea, their survival and wellbeing are maximised. A centrepiece of this is the hatchery and smolt facility at Applecross on Scotland’s west coast.

Another reason for Jacobsen to feel optimistic is that the underlying performance of the Faroes side of the business continues to improve.

He says: “The Faroes operation has seen strong numbers and biology. We are getting a good margin and price.”

Biological performance has been good, the sea lice issue appears to be under control and the company is harvesting larger fish – which fetch a better price per kilo.

The two challenges that hit revenue and profits last year are, the company hopes, one-offs. Firstly, infectious salmon anaemia (ISA) was found at two Bakkafrost pens at the company’s Vágur site, in May. This meant that fish had to be slaughtered early, impacting their market price.

The discovery of ISA came as a shock to the Faroes industry, which has had a very good record in recent years in staying free of viral infections.

The second challenge came in the form of a general strike in the Faroes. There is one lead union in the islands, organised nationally, so Bakkafrost was just one of many employers affected by the four-week stoppage. Eventually the union, which had been demanding a 20% pay rise, settled for a 13% agreement over two years.

For Bakkafrost, the feed division Havsbrún was hardest hit as it was hard to source raw materials during the strike, and the amount of feed available to sell to other fish farmers was severely limited. For the whole of 2024, Havsbrún produced 66,414 tonnes of fishmeal compared with 101,976 tonnes in the previous year.

Jacobsen said: “Taken together, the financial impact of the strike and ISA amounted to DKK 250 million – DKK 300 million [£28m - £33m].”

Overall, however, Bakkafrost appears to be moving in the right direction.

Jacobsen explains: “Larger, more robust smolts have been a key part of our success. But so also has been our ability to keep the fish healthy through treatments. We now have all-time low sea lice numbers and a low level of mortalities.”

Bakkafrost has adopted a freshwater treatment approach to deal with sea lice and other issues.

In parallel with the Applecross site, the company is also investing in two new or extended sites in the Faroes: the hatchery at Skálavík and the expansion of the Havsbrún feed factory.

The Skálavík hatchery will have a total capacity of 28,600m3 and is expected to be up and running in late 2026.

The annual production will be around seven million smolt at a size of 500g. Once Skálavík is completed, Bakkafrost’s annual smolt production capacity will be in excess of 24 million smolt of 500g.

Jacobsen explains: “The expansion of our freshwater sites is partly a result of the issue that there are fewer seawater sites available, either in the Faroes or Scotland.

“More freshwater sites mean two years at sea can be reduced to one year. So, for many years to come we can reduce risk, and increase output and efficiency.”

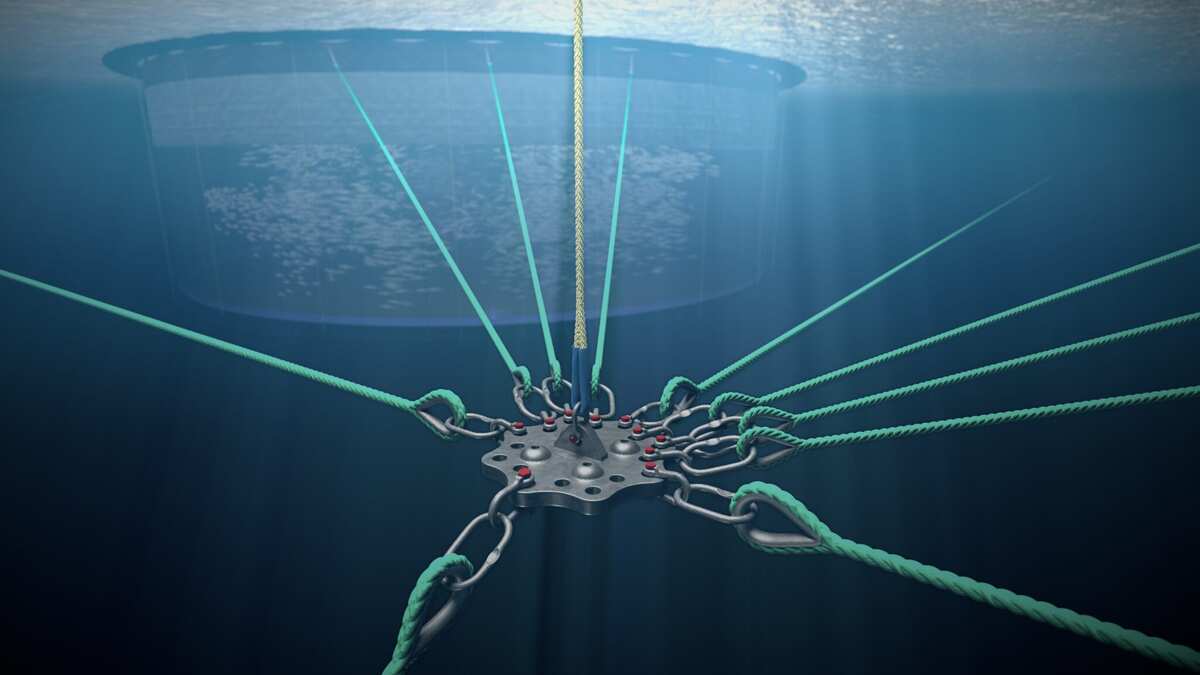

How about expansion to exposed sites further offshore, as has been mooted for Norway?

Jacobsen says: “Offshore is an option – maybe – but it’s expensive. It’s a matter of timing. If you do the expensive things too early, you will not be competitive. Use the low hanging fruit!”

Meanwhile, Bakkafrost continues to innovate in terms of how it brings its fish to the market. In December it launched an online retail operation bakkafrostshop.com for consumers in Denmark, the Faroes and the United States to buy premium salmon products directly from the producer.

Jacobsen says: “It is a limited volume, but it gives us another way to reach customers. We have done it for a few years in the USA, and now we are doing it for the Faroes and Denmark.”

Bakkafrost also now runs its own airfreight service, FarCargo, which made its first flight in March last year. The company has one plane, a Boeing 757-200. The original plan was to fly between the Faroes and Newark, with a maximum capacity of 30 tonnes, but Bakkafrost found it was more efficient to fly to Brussels and Dublin, making two or three trips a day. As Jacobsen explains, there is plenty of capacity in Brussels and Dublin for the onward journey to the US.

Jacobsen says: “FarCargo reduces our CO2 footprint and increases the shelf life of the product by three days. We can also reduce the weight of ice required.”

Tax becomes less taxing?

One piece of good news for Bakkafrost and the other Faroese fish farmers was the announcement in January of reforms for the island’s salmon tax regime.

As Ragnar Nystøyl, Chief Analyst with consultants Kontali, says: “The Faroes ’market fee’ or ’harvest fee’ has changed three or four times over the past few years.”

Broadly, the Faroes salmon tax was based on revenue rather than corporate profits, taking into account market pricing and later also production costs. Rather than rely on market prices as reported by the farmers, Norway’s Fish Pool Index – which reflects spot market prices achieved by a panel of Norwegian exporters – was used as a benchmark.

The percentage basis for tax levied went up and down on a sliding scale depending on the market price, and when salmon prices were riding high, this could be as much as 20%.

As Nystøyl explains, the cost element of the calculation was based on companies’ audited accounts. As an indicator, this lags behind the price index, so when both prices and costs were rising steeply, as in the past two or three years, farmers found themselves losing out.

Another factor, he says, is that Norway forbids the export of “production grade” salmon – that is, those that are good enough for fillets but not for export as whole fish. The increasing proportion of production grade fish in Norway’s total output – because of problems like winter wounds – means that the Fish Pool Index reflected the price of superior grade fish only rather than the average value for salmon on the market.

And because the DKK has fallen against the Norwegian kroner, the high reference price also works against the Faroese farmers.

Bakkafrost’s Regin Jacobsen says of the previous tax regime: “It had a negative impact on our competitive position, especially on our ability to take on long-term contracts.”

The new system, announced in January, limits the revenue-based element of the tax to a maximum of 7.5%. A new profit-based element has been introduced, adding 12% to the Faroes’ standard corporate tax rate of 18%. This supplementary rate only applies, however, to marine activities – ie raising salmon in saltwater – and not to smolt production, service vessels, feed sales or value added products/processing.

Regin Jacobsen says: “The new system is better and gives us some competitiveness. It also has the support of a broad [political] coalition. The main opposition parties have agreed and have committed not to make changes for several years to come.”

So will the Faroes salmon industry pay less tax now? Ragnar Nystøyl says: “That’s a tricky question. As analyst, I think so but there are a lot of ifs and buts. For example, it will depend on what happens to the salmon price this year.”

Kontali expects an increase in the supply of salmon this year, and therefore a softening of the price.

Nystøyl observes: “The detail in the Faroes’ salmon tax is more pragmatic than the Norwegian tax, which is more detailed and bureaucratic.”

“Pragmatic” is probably a good way to describe the Faroes’ approach to fish farming and fisheries in general.

The Faroese have over the years shown the ability to think innovatively in response to challenges like fish diseases and reduce quotas for catch fishing.

As the saying goes, necessity is the mother of invention; or, as Regin Jacobsen puts it: “When you are in difficulties, you find solutions.”

Supporting cast

Fisheries and, increasingly, fish farming are key industries for the Faroes and part of the islands’ culture. Not surprisingly there is also a thriving industry supporting those sectors. Three examples show the depth of expertise in this small nation.

Vónin is a prominent name in the fishing and aquaculture industries. In the aquaculture sector, Vónin provides cutting-edge equipment for fish farming. This includes nets for fish cages, feeding systems and other essential accessories. The company’s aquaculture solutions are tailored to enhance productivity and ensure the wellbeing of the fish.

MEST Shipyard is a renowned maritime facility that specialises in the construction, maintenance and repair of various types of vessels. With a rich history and a reputation for excellence, MEST Shipyard offers a comprehensive range of services tailored to meet the needs of the maritime industry, including shipbuilding, repair and maintenance, naval architecture, structural engineering, and mechanical and electrical systems design.

On the research side, Firum has an international reputation as an institution with expertise in the ocean, aquaculture, agriculture and renewable energy. Its researchers have worked with and continue to collaborate with leading institutions throughout Europe.

For more Faroes news and features, see the Faroes Sector Focus on this website.