Aquaculture bounces back

The Global Seafood Alliance (GSA) Conference – notionally in Seattle this year, but actually online – saw the unveiling of the GSA’s global aquaculture production surveys and forecast, covering finfish and shrimp.

Both surveys were produced by the GSA in association with Rabobank, with additional data from the United Nations Food and Agricultural Organisation (FAO) and analysts Kontali. Production growth estimate for 2020 and 2021, and forecasts for the coming year, were based on input from producers.

The results were presented by Gorjan Nikolik, Senior Analyst, Seafood, with Rabobank.

Shrimp shine in 2021

For the shrimp sector, it was a story of recovery from the slump in 2020, with further growth to come.

Nikolik said: “For Latin America as a whole, it’s been a booming year for shrimp production.”

Mexico’s production of vannamei shrimp declined slightly in 2020 compared with the previous year, but estimates for 2021 suggest that, at just under 180,000 tonnes, the current year’s out will be 8% up year on year.

Brazil’s output is expected to be at least 65,000 tonnes or more according to the GOAL survey, with some estimates predicting as much as 100,000 tonnes.

Ecuador remains a strong performer in the field, with continued year-on-year growth of 5.1% even during 2020 and expected growth of 10.2% to reach just under 800,000 tonnes.

Indian production contracted steeply by 12.5% in 2020. With 2021 output estimated at around 700,000 tonnes, it is expected to take until 2023 to get back to the production levels of 2019.

China’s figures are controversial, Nikolik said. Officially, shrimp production in China passed 2 million tonnes in 2018, with just under 2.2 million in 2019.

Rabobank’s alternative assessment, based on industry sources, suggests 2019 output was more like just over 500,000 tonnes, representing a slight fall compared with 2018.

Applying industry expectations to official data, Rabobank suggests growth is resuming after a fairly flat 2020, with 9.1% growth in 2021, or a total for the current year of more than 2,300 tonnes.

Vietnam is expected to record 13.6% growth for 2021, to around 760,000 tonnes, although growth next year is only predicted to be 0.9% and Rabobank feels official figures may be overstated.

Indonesia’s figures are also disputed. Rabobank feels the official figures for 2019, of over 900,000 tonnes, are over-optimistic and believes the real figure, based on industry sources, could be more like 380,000 tonnes.

Thailand, meanwhile, will see an estimated 7.8% in growth for 2021, taking the country’s production to just over 400,000 tonnes, while smaller producers such as the Philippines and Malaysia appear to be pretty flat in growth terms. In total, production in 2021 for south east Asia – not including China – is expected to be around 1.6 million tonnes.

Using an estimate based on official figures supplied to the UN Food and Agricultural Organisation up to 2019, global shrimp production for 2021 will be around 7 million tonnes, up 8.9% on 2020, which had seen a fall of 2%.

Rabobank’s own estimate – taking out overcounting for China, Indonesia and Vietnam – applies the same expected growth rate, but comes up with a global figure of just under 4.5 million tonnes.

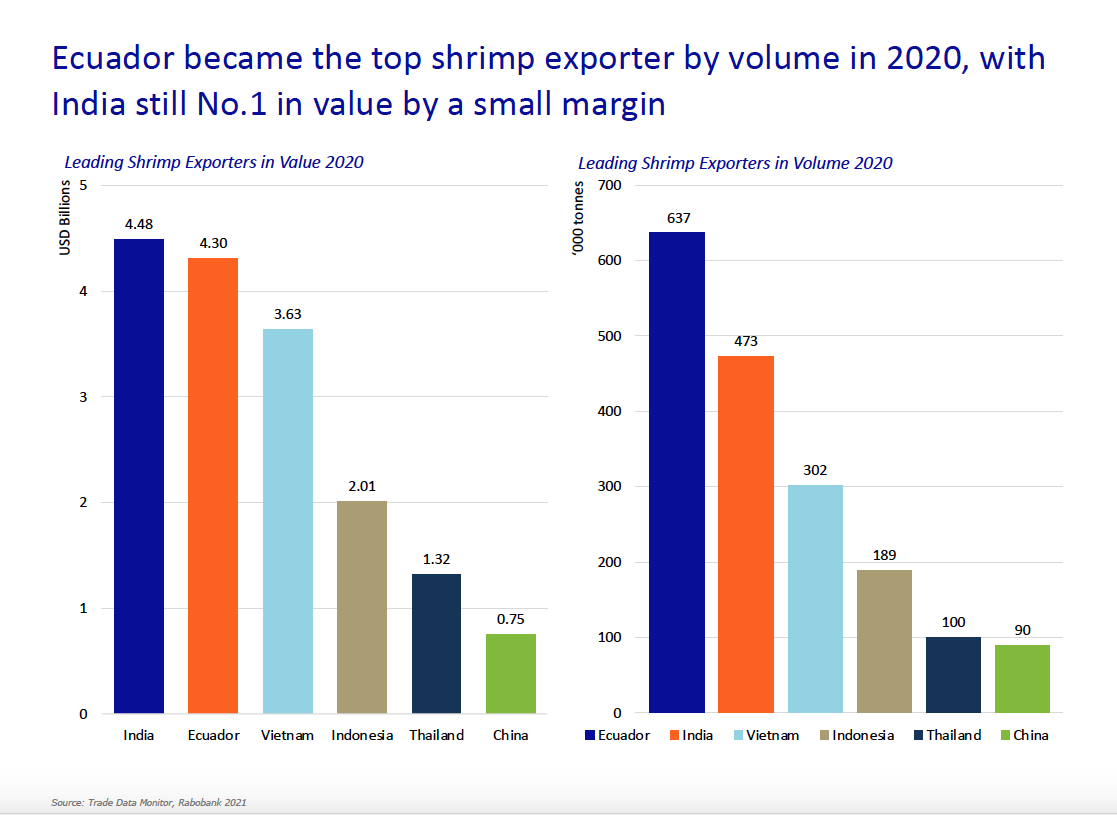

In 2020, India was still the world’s top shrimp exporter by value (US$4.48bn), but in volume terms Ecuador took the top spot, at 637,000 tonnes. For the year to date – up to July 2021 – Ecuador as leading on both counts (at US$3.09bn and 522,000 tonnes).

The GSA’s survey of producers suggest that further growth globally is expected for 2022, although producers are less optimistic about the impact of rising feed prices. In descending order, their top three concerns were market prices, disease prevention and the cost of aquafeed.

A tale of two salmon nations

The Global Finfish Aquaculture Survey and Forecast found that 2021 was a very different story for two of the leading Atlantic salmon producers: Chile and Norway.

Norwegian farmers expect to record just over 10% growth, to around 1.5 million tonnes for 2021 after growth slowed to 2.7% in 2020.

Another 4.6% in growth is expected for 2022. Nikolik observed, however, that thanks to environmental regulations, Norway is approaching the limits of its capacity for marine fish farming.

In Chile, estimated production for 2021 has actually slumped by just over 14% compared with 2020, taking production to a little over 600,000 tonnes. One of the key factors for Chile has been biological issues, which have led to die-offs and culls of fish.

UK salmon producers expect to record a big increase for 2021, with around 210,000 tonnes compared with 2020’s estimate of around 175,000 tonnes. In contrast, Canada’s production, at around 140,00 tonnes, has been flat and is expected to remain so.

The “others” in salmon farming – including Iceland, Australia, Ireland and the US – are becoming increasingly significant, Nikolik said. With combined production topping 160,000 tonnes, estimated year-on-year growth for 2021 is 20% and growth is expected to continue at around 6% for the next two years.

Norway’s growth spurt and Chile’s misfortunes have cancelled each other out to create an expected steady growth curve for salmon production between 5.2% and 4.4% over 2020 to 2022, slowing to 2.8% in 2023. Estimated global production for 2021 is around 2.8 million tonnes.

Other species

Atlantic cod production in Norway is experiencing a revival, the survey shows. From its high of around 22,500 tonnes in 2010, production declined to just over 5,000 tonnes by 2019, but that is now growing and 2021’s estimate is more like just under 10,000 tonnes, with further growth of more than 47% expected for 2022.

Meanwhile sea bass and sea bream production – still led by Greece and Turkey – appears to be recovering from the slumped levels of 2020, with an estimated 3.8% increase taking the expected total for 2021 to just under 500,000 tonnes. This is still marginally below the industry’s previous high in 2019, but 1.2% growth in 2022 and 4.2% in 2023 should see production reach new peaks in those years.

Tilapia is a mature sector for established producers such as China and Indonesia, but it is growing in Bangladesh, the Philippines, Vietnam, Egypt and Latin America.

The FAO estimated that world tilapia production was around 5.5 million tonnes in 2019. Since then, the GOAL survey estimates, total production has grown by 1.2% for 2021 and will see further growth of 2.5% in 2022 and 3.7% in 2023.

Production of pangasius, a large catfish, is estimated at 3 million tonnes for 2020, up 3.7%, with a further 6% increase year on year for 2021.

Growth in carp production – a huge industry in which China is by far the biggest player – appears to be slowing. Estimated production for 2021 is just over 24 million tonnes and growth for next year is only expected to be 1.6%.

The big picture is that global finfish production for 20121 is likely to be around 38 million tonnes, up 2.5% on the estimated figure for 2020, which had seen growth of only 0.2% from 2019. The industry expects to see further growth of 2.7% in 2022.