A year of growth: Rabobank's upbeat forecast for 2025

Production increases are expected for key aquaculture species in 2025, with modest growth for salmon and shrimp.

The global aquaculture industry should see improved production growth for key species in 2025.

That’s the upbeat message in the latest Global Outlook report from RaboResearch, part of the Rabobank group.

Finfish production is poised to see the greatest growth, the report says, while shrimp, which continues to face relatively low prices, is expected to grow just 2% year-on-year. Lower feed prices and better demand should benefit producers. However, increasing tariffs and trade restrictions may impede the industry.

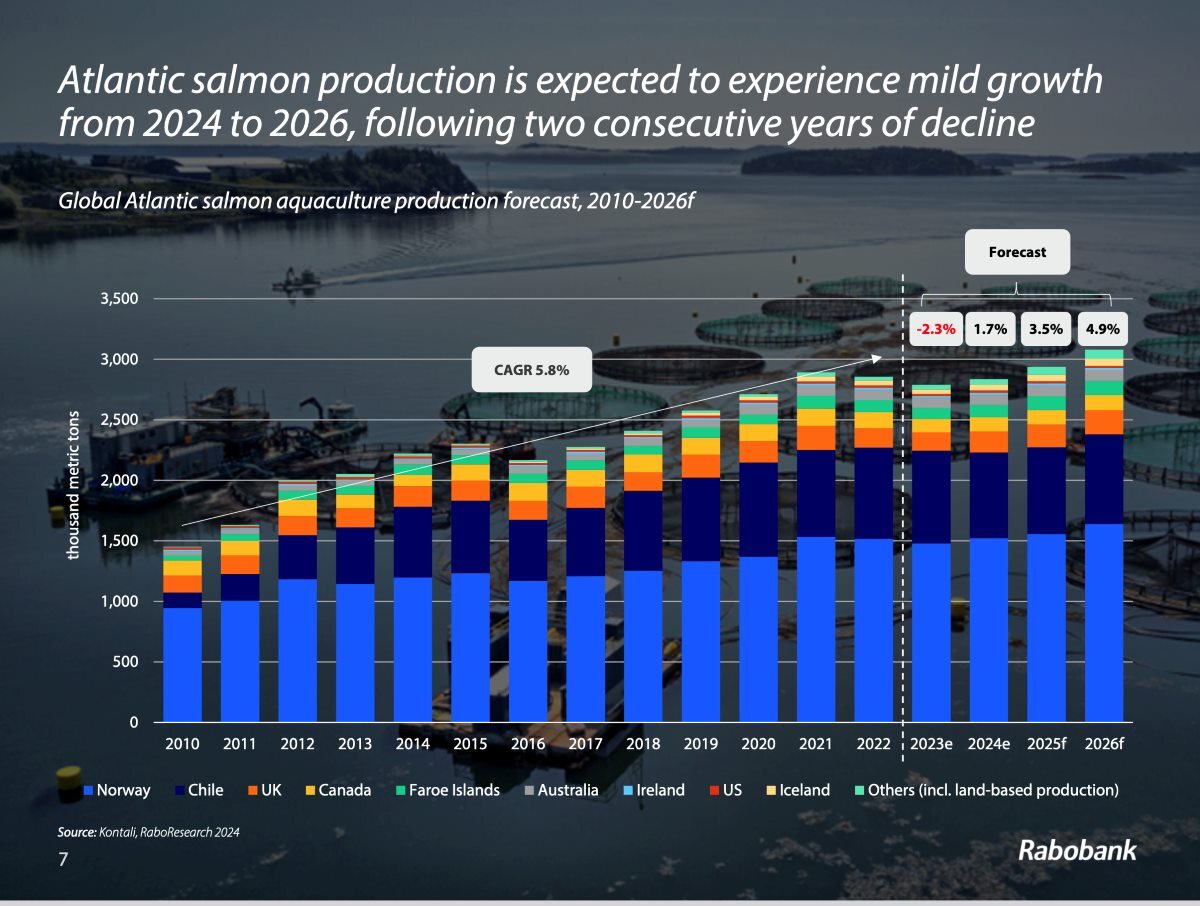

Salmon to return to growth in 2025

Novel Sharma, Seafood Analyst at RaboResearch, says: “Atlantic salmon production is expected to experience mild growth from 2024 to 2026, following two consecutive years of decline.

“Norway is poised to lead the growth, with year-on-year increases projected at 2.2% in 2025 and 5.3% in 2026, resulting in estimated outputs of 1.56 million and 1.64 million metric tons, respectively. This growth is contingent on stable biological conditions and improving harvest weights.”

After a difficult 2024, Chile is expected to gradually return to a growth trajectory, with a 1.4% year-on-year production increase expected in 2025 and 3.2% in 2026. However, production volumes are unlikely to surpass 2020 levels before 2026.

Shrimp production to remain slow amid ongoing low prices

“Despite relatively low prices, we expect global shrimp production growth will remain positive,” says Sharma.

After years of strong growth, shrimp production is slowing, with volumes projected to increase by only 1% year-on-year in 2024 and 2% in 2025.

Latin America’s shrimp production is expected to slow, with growth rates dropping to 2% in 2024 due to lower prices. However, growth is anticipated to rebound to 4% in 2025 as the oversupply situation eases. Ecuador’s shrimp production, the world’s fastest-growing major aquaculture industry, will also experience a slowdown.

China and India are poised for modest growth in 2025 – 1.7% and 2%, respectively. Meanwhile, Vietnam’s production is forecast to grow by 4% in 2025, although disease management and high production costs continue to pose challenges.

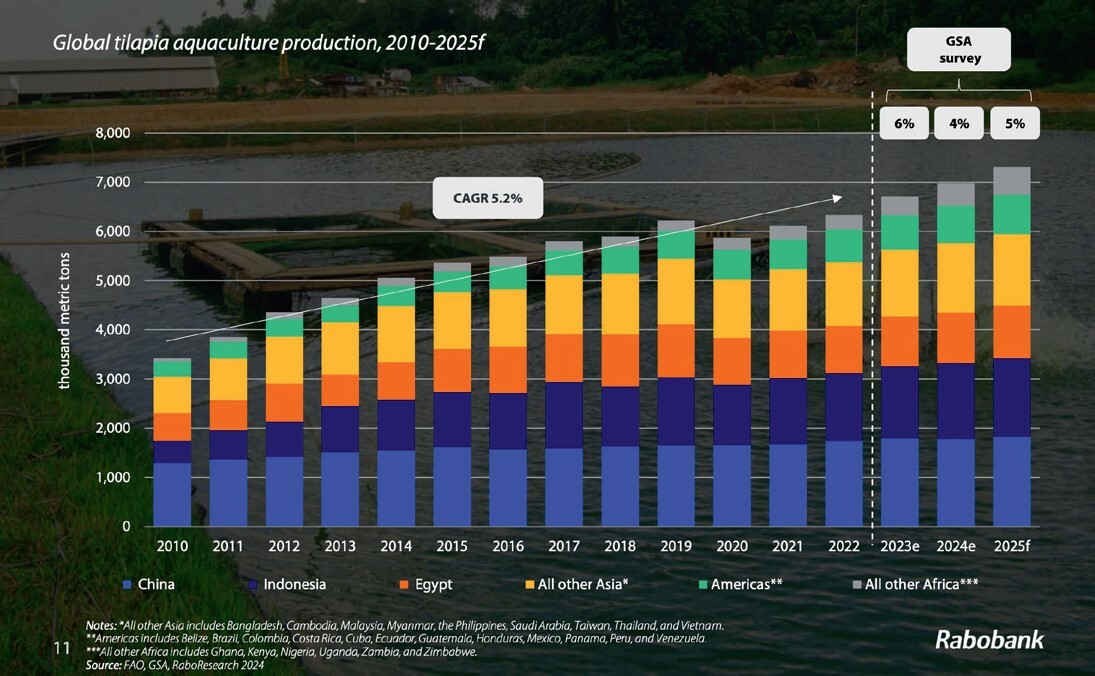

Pangasius and tilapia to see fastest production growth

Freshwater species are expected to have the highest growth among farmed species. Pangasius production is expected to grow robustly, up 7% year-on-year, with Vietnam leading the way, bolstered by rising demand from China. Global tilapia production is forecast to exceed seven million metric tons, up 5% year-on-year, driven by strong growth in China and Indonesia.

Trade uncertainty ahead

According to RaboResearch’s annual aquaculture survey on finfish and shrimp production, performed in cooperation with the Global Seafood Alliance (GSA), the industry remains concerned about the market and economic conditions heading in 2025. Ongoing geopolitical uncertainties pose significant challenges.

“Seafood is the most traded animal protein, with a larger trade value than all other animal proteins combined,” explains Sharma. “Donald Trump’s presidential victory in the US could mean new import tariffs. This is especially significant for the seafood sector, as the US is the world’s largest importer, relying on imports for over 80% of its seafood consumption. Moreover, the potential trade war is likely to involve China, the world’s largest seafood producer, exporter and reprocessor.”

Market prices a key industry concern

According to survey results, market prices are once again the top industry concern heading into the coming year, followed by aqua feed costs and market access. “This is understandable,” says Sharma. “2024 had some of the lowest seafood prices we have seen in many years.

“Although demand has started to improve for many species, prices are increasing from a low point, and the improvement is tentative. Possible trade restrictions from the US and the uncertain recovery of Chinese, Japanese and European import demand in 2025 are clear concerns.”

Global aquaculture outlook: Key takeaways

North America

• Canada’s salmon production is expected to rebound with 6% growth for 2024, followed by 1.4% in 2025 and 3.2% in 2026, after a 16% decline in 2023.

• Mexico’s shrimp production is projected to grow by 4% in 2025, surpassing the peak levels reached in 2020.

China

• China will remain the largest tilapia producer, growing by 2.4% in 2025, but growth may slow due to price pressure, trade tensions and new environmental standards.

• China’s annual shrimp production is expected to report growth up 4.5% for 2024 and 1.7% in 2025, driven by efficiency gains from advanced aquaculture technologies.

Europe

• Norway is set to lead global salmon production growth, with annual increases expected at 2.2% in 2025 and 5.3% in 2026, accounting for the majority of nominal volume growth.

• The UK is expected to experience significant growth, with salmon production rising by 15% for 2024, 7% in 2025, and 6% in 2026, reaching 200,000 tonnes.

• Turkey’s sea bass and sea bream production is projected to slow to around 2% annually over the next two years, indicating market stabilisation.

Africa

• Tilapia production in Egypt, Africa’s tilapia leader, is recovering and expected to grow. After stagnant output from 2020 to 2022, a 2% increase is estimated for 2024 output and 4% for 2025.

• Zambia’s tilapia production is expected to be up 43% for 2024 and 7% in 2025, making it the fastest-growing tilapia producer in Africa.

• Ghana’s tilapia production is expected to show an increase of 9% for 2024 and 6% in 2025, driven by gradual improvement in access to genetics and technology.

South America

• Ecuador’s shrimp industry, the fastest-growing major aquaculture industry in the world, is shifting to a lower gear, slowing production growth.

• Brazil’s tilapia production is expected to rise by 9% in 2024 and 7% in 2025. Growing US demand may lead producers to encourage farmers to boost production for export.

• Chile’s salmon production is expected to grow by 1.4% in 2025 and 3.2% in 2026 but won’t surpass 2020 levels before 2026 due to uncertainty around biological challenges.

South-east Asia and India

• India’s vannamei supply is expected to grow by 2% in 2025 after shrinking by 4% in 2023 and 3% in 2024.

• Indonesian tilapia production is expected to grow by 3.6% in 2025, reaching 1.6m tonnes, close to China’s 1.8m tonnes.

• Vietnam’s shrimp production is forecast to grow by 4% in 2025, but disease management, high costs and fluctuating prices remain challenges.

• Vietnam’s pangasius production is expected to report growth up 5% for

2024 and 8% in 2025, driven by rising Chinese demand for lower-priced freshwater fish.