Sector set for growth

Rabobank’s look ahead to 2024 suggests better days are coming for aquaculture producers, reports Vince McDonagh

After a turbulent 2023, the aquaculture industry – and the salmon sector in particular – looks set to rebound next year, according to a report based on input from producers worldwide.

What to expect in aquaculture in 2024, the latest report from the Dutch-owned financial group Rabobank in co-operation with the Global Seafood Alliance, paints a brighter picture for fish farming.

They believe shrimp production, which has endured a turbulent year, will be back to growth and so too will salmon, tilapia, pangasius and sea bream output.

Rabobank says industry responses to its survey suggest a more optimistic outlook for 2024.

Highlights of the survey, relating to the five key finfish species/groups, were presented at the Global Seafood Alliance’s Responsible Seafood Summit 2023 (see “On course for growth”, Fish Farmer November 2023). The latest report details expected production by country and includes Rabobank’s predictions for the shrimp sector.

Higher production will be led by Norway, with growth of 3.7% in 2024

When it comes to finfish, the report says optimism abounds for the major farmed species. Salmon, tilapia, pangasius, sea bream and sea bass are all expected to grow, although the periodic climate phenomenon El Niño poses potential risks for some species and regions.

The report states: “After two consecutive years of weak global production growth, global Atlantic salmon production reached an inflection point in Q3 2023.

“Higher production will be led by Norway, with year-on-year growth of 3.7% in 2024 and even higher growth at 4.9% in 2025, culminating in estimated production of up to 1.67 million tonnes in the next two years.

“But this will depend on limiting the risk of biological issues during the period and ensuring the benefits of smolt stocking over the past 12 months continue.”

The report continues: “The harvest rate was relatively poor in 2023 due to disease issues. Now the indication is that it will be better in the future: there are lower sea lice numbers and less medication use. In the longer term, it is really the only country that is structurally growing: 2% to 3% growth in Norway is possible and it is a lot.”

It mentions the Faroe Islands and Australia as two emerging salmon farming countries to watch.

And it highlights Iceland as the arguably most important small emerging salmon farming country, because it is close to both the United States east coast and also to Europe, allowing it to sell salmon without freezing.

However, there is no mention of the recent sea lice outbreak in the west of Iceland during October and November, which has resulted in large scale mortalities, so presumably the report was written earlier.

Salmon farm

by the bay of Cochamo,

Los Lagos, Chile

It does point, however, to uncertainty around Chile’s volume growth over the next decade due to new legislation and biological issues.

It is unlikely that Chile production volumes will eclipse the (high) 2020 levels before 2025. Year-on-year growth is forecast at 2% in 2024 followed by a 1.8% decline in 2025.

There are also fears that increased temperatures due to El Niño conditions may lead to more incidents of algal blooms resulting in higher mortalities.

Shrimp sector set for better days

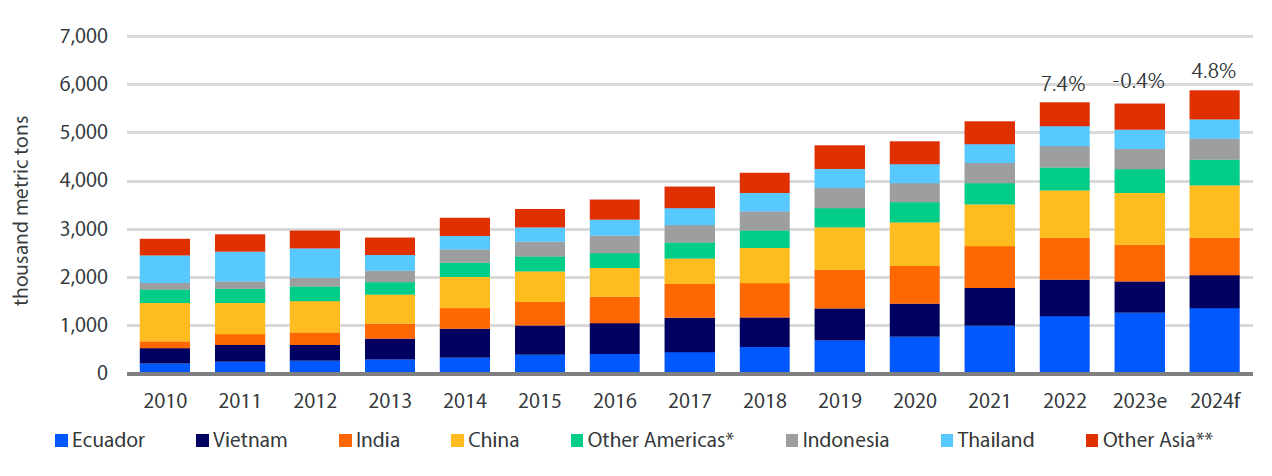

The report predicts a better year ahead for shrimp, which should return to growth next year, albeit at a lower rate than the 10-year historical average. The survey results forecast year-on-year shrimp production growth of 4.8% in 2024, surpassing the peak volumes in 2022 after an expected modest decline of 0.4% in 2023. But in Ecuador, production growth is expected to decelerate in 2024.

There is optimism for Asian shrimp production, with survey respondents forecasting a potential recovery of 4% in 2024, following the region’s first decline in a decade in 2023.

“This will depend on prices improving in 2024 after the continuous downward trend in 2023, which made the majority of the industry unprofitable,” said Rabobank analyst Novel D.Sharma. Likewise, production in India and Vietnam is set to recover in 2024, following sharp contractions this year.

Sea bass and sea bream is expected to accelerate over the next two years at a year-on-year growth rate of 3.9% in 2124 and 4.7% in 2025. Turkey’s continued expansion will be the primary driver, with year-on-year growth of 4% next year and 6% in 2025, surpassing 250,000 metric tonnes.

Following a pause three years ago, tilapia production has been gradually recovering and should have grown by just over 5% this year. Looking ahead, strong growth is expected in Asia and Indonesia in particular. China is likely to maintain its position as the world’s top tilapia producer in the near term.

But the report also points out that if consumers continue to prefer premium seafood species, fish farmers could change what they produce, potentially decelerating tilapia growth.

A recovery in pangasius production is also expected next year with an increase of 2.8% likely, provided demand increases and inventory levels diminish, especially in China.

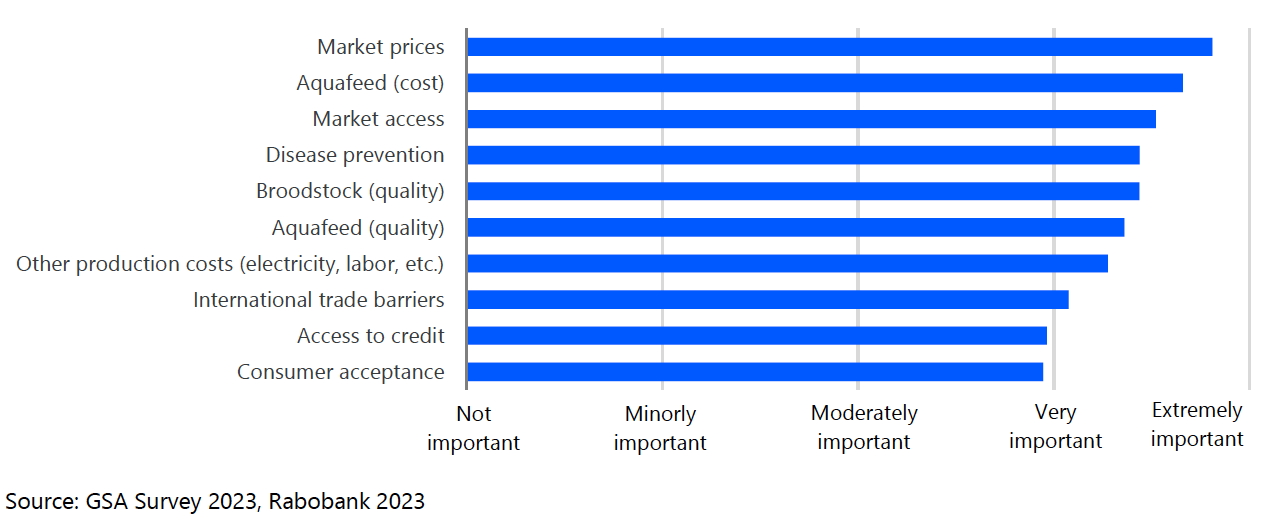

The survey also asked industry experts about market prices, which have emerged as one of their top concerns. There remains uncertainty over the effects of persistent inflation and a recovery in seafood demand.

Elevated costs and stagnating household disposable incomes remain major challenges for consumers, who may look to trade down either within the seafood category or by switching to a lower-priced protein option.

Aquafeed costs remain an area of concern in the coming year. The majority of industry respondents did not expect feed prices to be lower, the Rabobank survey concludes.