AquaBounty sees increased revenue – and losses – for Q4

Land-based salmon farmer AquaBounty Technologies has reported a year-on-year revenue increase of 23% for the last quarter of 2023, but the period also saw losses growing.

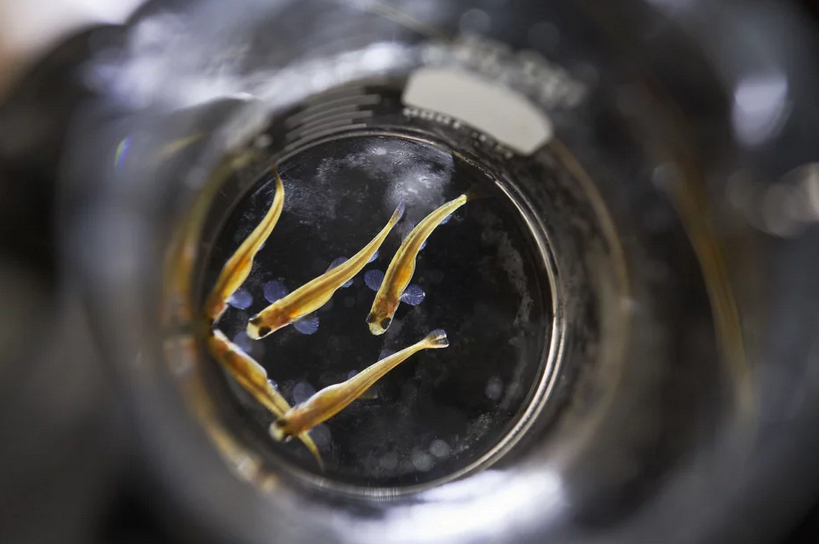

AquaBounty has developed a genetically modified (GM) strain of salmon, aimed at faster growth and suitability for farming in RAS (recirculating aquaculture systems) facilities.

For Q4, the company recorded revenue of US $553,000 (£440,000) in product revenue, with US $451,000 (£359,000) for the same period in 2022. Net loss in the fourth quarter was up significantly at $8.42m (£6.7m) as compared to $6.07m (£4.83m) in the fourth quarter of 2022.

For the year ended 31 December 2023, however product revenue totalled US $2.47m, (£1.97m), a year-on-year decrease of 21% as compared to US $3.14m (£2.5m) in 2022. For the year ended December 31, 2023, net loss increased to US $27.56m (£21.92m), as compared to US $22.16m (£17.63) in 2022.

Sylvia Wulf, Board Chair and Chief Executive Officer of AquaBounty, explained that the revenue drop was largely down to an interruption in production at the company’s Albany, Indiana site, early last year.

She said: “Our financial results for 2023 are indicative of the financial and operational challenges that we encountered during the year.

“We began the year with a limited ability to harvest at our Indiana farm, as needed repairs were performed on our processing building. By the time the facility was fully back in operation in early May, the market price for Atlantic salmon had begun to fall. This continued through the second and third quarters and only partially recovered during the holiday season in the fourth quarter. The result was a decline in year-over-year revenue, even though our total production output increased by 14%.

“Our net loss for 2023 increased over the prior year, primarily due to sharp increases in spending for state excise taxes, legal fees, and outside consulting, the latter two driven by our fundraising efforts. We also were impacted by another significant increase in the cost estimate for our Ohio farm, which forced us to pause both our construction activities and our municipal bond financing transaction in June.”

Sylvia Wulf, CEO, AquaBounty Technologies

Burning cash

AquaBounty’s business model depends on gearing to full scale production at its site in Pioneer, Ohio. With faltering production in Indiana and a pause in construction in Ohio, the company has been burning through its cash reserves. As at 31 December 2023, AquaBounty held US $9.2m (£7.32m) in cash and cash equivalents, compared with US $102.6m (£81.61m) 12 months before.

Wulf said: “Faced with these challenges, we began exploring a range of financing alternatives to strengthen our balance sheet and increase our cash runway. We announced in February 2024 that we had made the decision to sell our Indiana farm operation in order to increase our cash position and to decrease our ongoing cash burn. Additionally, we engaged Berenson & Company as our investment bank to advise on debt financing secured by our unencumbered assets and on additional funding alternatives that are necessary to resume and complete construction of our Ohio farm and pursue our longer-term growth strategy.”

She confirmed that operations at AquaBounty’s farm on Prince Edward Island, Canada, are continuing to expand with the installation of additional egg incubation capacity, which will allow the company to increase the availability of non-transgenic Atlantic salmon eggs and fry for sale to salmon farmers, for an additional revenue stream.

Wulf concluded: “We have a fully engaged and committed management team that is focused on dealing with our challenges and taking the necessary steps to support our future growth.”

AquaBounty RAS farm, Albany, Indiana